Pocket Money

My daughters had just turned 5 and I detected their idea of spending (*insert buying the object of their desire) had shifted over the past months, leaving me feeling more like the unappreciated proverbial cash cow / parent trying to avoid a monumental tantrum in the shops!

I noticed that although their knowledge on identifying money in terms of recognition of notes and coins was quite sound their thinking on the source of our money was very abstract and concluded this might be due to their observations of the ease of tapping plastic when accompanying me on shopping excursions and that they probably thought that our family funds more likely stemmed from the pot of gold at the end of the rainbow! Even though discussions around money, earning, costs and buying have taken place I still noticed and increase in requests accompanied with dramatic use of pleading eyes and the desperate use of please, or rather pleeeeeeeeeeese!

Witnessing a further decrease for the value of the purchase felt quite disrespectful to the energy and life force it took me to earn it and this feeling initiated the road to starting pocket money.

So what is Pocket Money – I believe it is a useful tool in the road to good Money management (earning, saving, spending, borrowing, and repaying money.) To manage money well, you need financial literacy, or more simply said, have the ability to manage money in ways that help you achieve your goals in life in support of our definition of a happy life. Essentially managing our money well allows us to see it as a useful tool and use it as such.

Pocket money becomes a practical way to explore and introduce children to money and teach an important life skill. This project proved to be an invitation to think about my own beliefs around money and even re-think limiting beliefs or patterns that I would not want my children to repeat. Essentially, I wanted to create an interactive ritual that would allow my children to experience money as a tool that when managed well can create a life that you love but that includes generosity and helping other people.

The challenge was that I wanted to teach them about money without “paying” them to do family chores or letting money” become the carrot for their choices and behaviour.

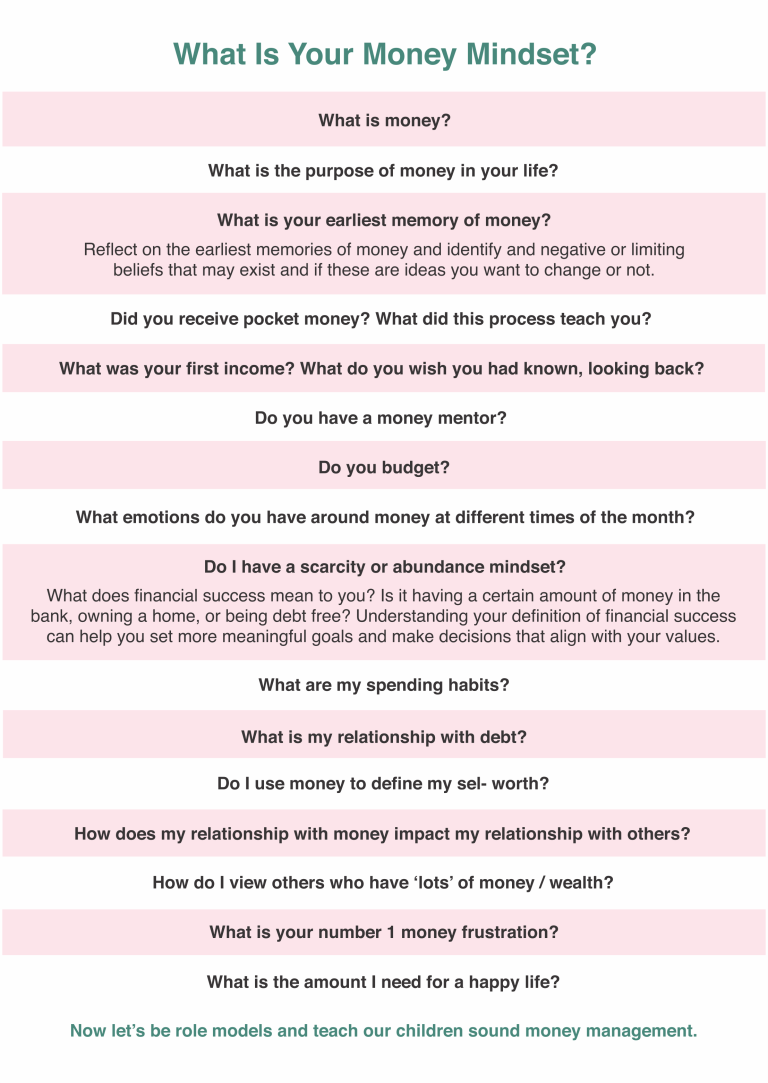

Identifying the key concepts that I wanted my children to take away from the experience came about after working through the Money Questionnaire. During this process I reflected on my relationship and beliefs around money and decided what ideas to “pay” forward, similarly I established what I wished I had known earlier or what not to repeat. Then I examined the ideas of some thought leaders and extracted a first few “money rules” that would also align with the values that underpin our family.

Since I had decided up front that I did not want pocket money linked to payment of daily chores as these are done in support of our family value around teamwork and I did not want this to become a monetary exchange I had to be clear on the purpose behind the practice and be authentic and conscious in what I was role modelling.

Since my children are still quite little, I have initially distilled the basic concepts associated with understanding money into three key ideas that served the values that I believe are important for their future. Give. Save. Spend.

I could build more advanced and abstract concepts from having a sound understanding of these ideas. I also felt a strongly interactive and visual system would support the money lessons.

The Following Points and Resources Formed Our Process

Print the pdf money jar labels and purchase 3 jars per child if you are implementing the GIVE / SPEND / SAVE method in your home. Preferably use a jar that can be viewed into without opening. (I found three plastic containers that increased in size)

Decide on the amount and payment day of pocket money. If you have a family calendar on display add this to the calendar for all members of the family to see. Depending on the child’s ability and age break the amount into the applicable jar amounts that you have decided to action during the worksheet. Example in our home we decided on the following breakdown. 10% (GIVE/charity) 20% (SAVE) and 70% (SPEND). With their age being 5 the weekly amount is provided in easy monetary amounts to sort into the jars from their pocket money envelope.

For clarification purposes if the pocket money amount is R20 per week – The following R20 is made up of R2, R4 and R14 and labelled, GIVE / SAVE /SPEND respectively making placement easy. Now, R2 goes into the give jar, R4 is placed in the save jar and R14 is put into the spend jar.

Another option is the 50-30-20 rule which recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category includes money you will need to realize your future goals.

Have a family meeting around the new concept and create the jars together and demonstrate the first “payment process.”

You are welcome to use the PDF attachment and create your Pocket Money Toolkit for your “money ready” child.

Note: To pay or not pay for chores? In our home our family value of teamwork is a key building block in creating a family structure that supports each other. The opportunity to contribute in an age appropriate manner benefits the importance of collaboration and teamwork as the motivator behind doing chores. This principle continues to grow as children mature and build an ideology that the completion of chores are in the interest of the greater good of the family. Ultimately the idea is that together we build a stronger home and family and when everyone chips in, we get more family time, free time and fun time! However, offers to help above and beyond family teamwork chores can have an extra monetary exchange. E.g, wash the car, take out the trash, work in the garden, laundry = additional R? (*decide on an amount) and the child can decide in which jar they wish to place it. This payment could be instant or worked on a tally system with payment made on the pocket money day in an envelope labelled “Thank you for your extra contribution to this family, your hard work is appreciated and valued. “

Precursor Knowledge required before commencing with pocket money:

Number recognition

what money looks like

- Physical money is notes and coins.

- Digital money includes debit cards, credit cards, gift cards and online transactions.

- Digital money can become physical money, and vice versa.

where money comes from.

What is money for? Money is for buying things we need and want.

Needs are things your family must have to survive. / Wants are things that are nice to have but your family can live without. (Spend your money on the things you need first. If you have any money left after buying what you need, you can spend it on things you want or you can save it.)

Resources

https://www.eastspring.com/money-parenting/20-things-to-teach-your-child-about-finances

https://www.merrilledge.com/article/teaching-kids-about-money-financial-responsibility

https://www.unbiased.co.uk/discover/personal-finance/family/how-to-teach-your-kids-about-money

https://www.moneyweb.co.za/financial-advisor-views/age-appropriate-money-lessons-for-children/

https://www.bankrate.com/personal-finance/parents-teach-kids-about-money-early-age/

https://www.schwab.com/learn/story/9-tips-teaching-kids-about-money

https://www.unbiased.co.uk/discover/personal-finance/family/how-to-teach-your-kids-about-money

https://www.discovery.co.za/corporate/podcast-teach-your-children-about-money

https://faithgateway.com/blogs/christian-books/age-appropriate-chore-charts

https://moneysmartfamily.com/moneysmart-family-book-info-page/

https://www.tonyrobbins.com/wealth-lifestyle/master-the-game-of-money/

https://ircwealth.com/money-mindset/questions-to-ask-yourself-about-your-relationship-with-money